Groww, India’s largest retail brokerage in terms of active investors, is all set for another mega new-age tech IPO after the huge gains seen by Urban Company earlier this week.

The fintech giant aiming to mop up nearly INR 7,000 Cr from the public market at a valuation of $7-8 Bn.

Groww is believed to have democratised wealth creation by bringing millions of India’s young digitally native users to the wealthtech space along with Zerodha.

While bootstrapped Zerodha has not outlined any plans to go public, Groww, founded by Lalit Keshre, Harsh Jain, Ishan Bansal, and Neeraj Singh – all former Flipkart executives – raised nearly $600 Mn so far from investors like Y Combinator, Peak XV Partners, Ribbit Capital and Tiger Global.

In fact, Groww will be the first Y Combinator portfolio company to go for an IPO on the Indian stock exchanges among the new-age firms.

Set up in 2016, the fintech company has scaled rapidly to reach a monthly active user (MAU) base of 18.07 Mn as of the first quarter of FY26, cornering a 25% market share in the NSE’s retail segment, according to its IPO documents.

The INR 7,000 Cr IPO will comprise fresh issues of INR 1,060 Cr and an offer-for-sale (OFS) component of up to 574.19 Mn shares, making up 82.5-85% of the issue size. The company had first filed for an IPO in May through the confidential route and it is unclear if OFS had a big share in it.

Groww’s DRHP throws up a tale of explosive growth. Its revenue from operations surged 49.5% to INR 3,901.72 Cr in FY25 from INR 2,609.28 Cr a year ago and flipped an INR 805.45 Cr loss into an INR 1,824.37 Cr profit in FY25.

Yet, its issue structure reflects the oft-repeated narrative in new-age company listings, where the OFS component is more than 50-60% of the overall issue size. This helps early investors reap massive rewards, leaving a modest share of the capital for the company.

As Inc42 looked deeper into the DRHP, it was found that the major investors would garner nearly INR 4,103 Cr if Groww lists even without any change in its last reported public valuation of $7 Bn.

While the IPO promises substantial exits for VCs, the founders will sell only a token 4 Mn shares that will fetch them INR 40 Cr. CEO Lalit Keshre and his fellow founders were given INR 614 Cr as performance-based incentives in FY25, shows the DRHP.

But, as retail investors scrutinise the filing, the question lingers: Will the heavy VC cashout erode trust, or will Groww’s growth story win them over?

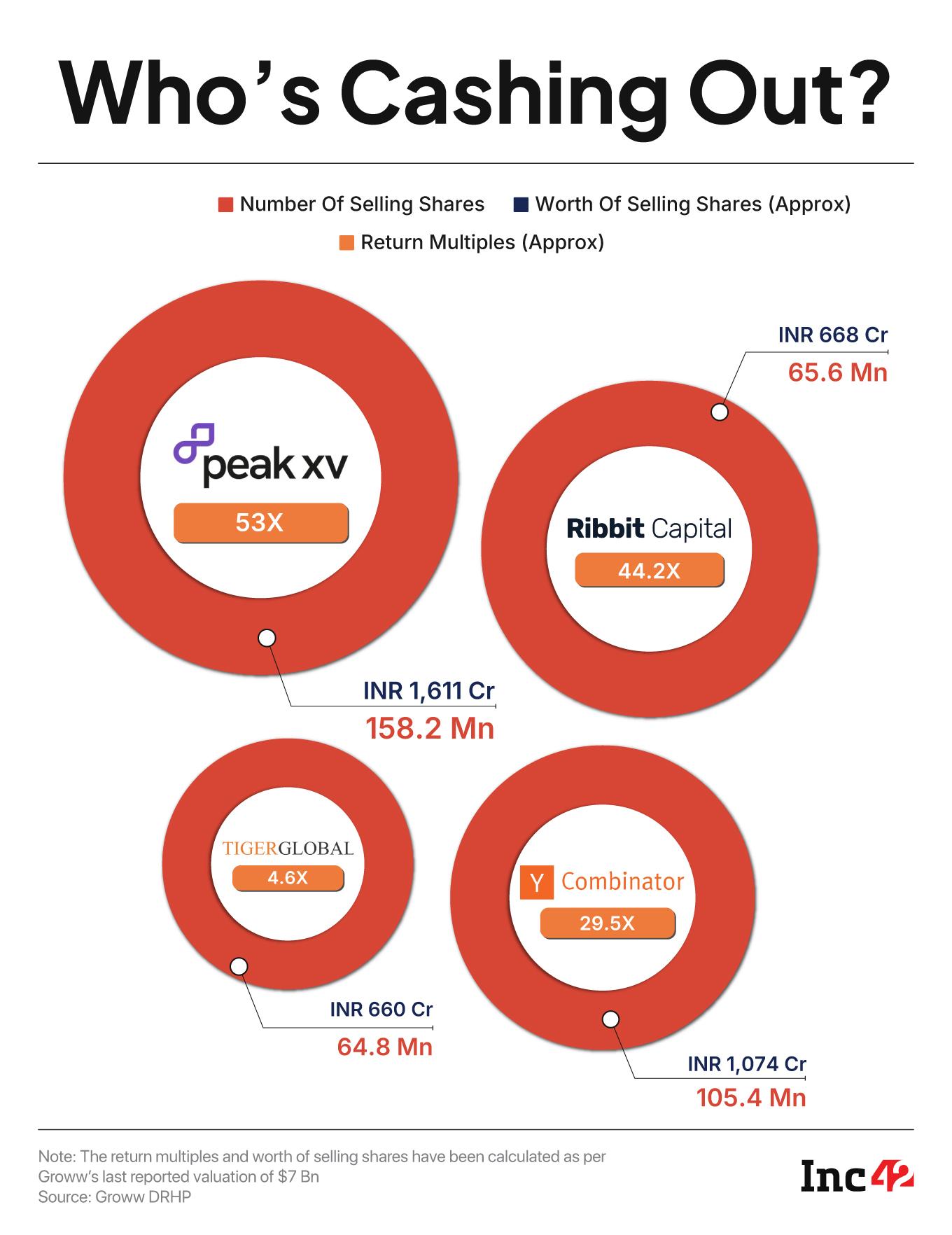

VC Bonanza: Cashouts Beat Cash InflowThe VCs that invested in Groww are in for a windfall gain from stakes they acquired for as low as INR 1.91 per share. Even at a $7 Bn valuation, these exits would yield in multiples of 4.6 to 53.3 on the shares sold.

The draft IPO paper paints a clear picture of investor cashouts at Groww with the listing. PeakXV Partners, with a 21.73% stake in Groww, is set to romp home with 53.3 times return from 158.2 Mn shares worth INR 1,611 Cr.

Y Combinator, one of the earliest backers of Groww, stares at 29.5-fold returns by liquidating its 13% stake, or 105.48 Mn shares, worth INR 1,047 Cr, shows Inc42’s back-of-the-envelope calculation.

Ribbit Capital, with 65.67 Mn shares, will corner INR 668 Cr, a 44.2 times return on its investment. Tiger Global, invested through Internet Fund VI Pte Ltd, is likely to draw INR 660 Cr from the sale of 64.80 Mn shares for 4.6 times return.

Collectively, the OFS is expected to unlock over INR 5,000-6,000 Cr for the investors, dwarfing fresh issues of INR 1,060 Cr.

In contrast, the four founders have parked 1 Mn shares each, retaining the bulk of their combined stake. This limited sell-off signals confidence in Groww’s future, but it also highlights the IPO’s primary role as an exit vehicle.

The DRHP said the proceeds will fund tech upgrades, marketing, and working capital, while the bulk of it will go out.

Analysts we spoke to seemed divided on this lopsided structure.

“The IPO will not significantly add to the balance sheet of the company, but will make investors richer,” Sahen Karamchandani, who founded wealth advisory firm WealthinIndia, said. He pointed at the DRHP’s emphasis on liquidity for early backers, and noted that Groww’s robust cash reserves of INR 2,500 Cr in FY25 mean that the fresh capital is more about credibility than necessity.

This sentiment echoes concerns from retail investors wary of ‘cashout IPOs’, where VCs harvest gains after years of growth fuelled by their capital.

Groww’s track record of turning profitable in FY25 even amid a general slowdown in the fintech space, can assuage fears, positioning the IPO as a validation of its model, rather than a bailout.

Sunny Agrawal, who heads fundamental research at SBI Securities Ltd, doesn’t see any headwinds for retail investors in the face of heavy VC cashout. “There are dynamics like topline growth and margin-focussed business expansion that will be crucial for retail investors as against seeing it from the lens of VC exit strategy. In fact, IPOs with a large OFS component aren’t unusual in Indian IPO markets,” he said.

A host of new-age companies debuted on the stock exchanges this year with large OFS components and received mixed responses from retail investors.

EV maker Ather Energy, for instance, raised INR 17,103 Cr with an over 82% OFS component, listing at a 2.2% premium to the IPO price with moderate retail subscription, while coworking space provider Smartworks mopped up INR 5,663 Cr with a 92% OFS component and listing at a 7% premium and receiving good retail subscriptions.

“Retail investors were drawn to established brands with clear growth narratives, despite high OFS (indicating investor exits). These typically performed well in the short term, but some new-age companies saw massive corrections in their share prices since last year. High OFS of more than 70% doesn’t always deter retail if the company shows profitability or market leadership,” Agrawal of SBI Securities said.

The Blueprint: Diversify To De-RiskGroww’s DRHP underscores a strategic pivot to reduce dependence on volatile brokerage fees, which accounted for around 85% of the FY25 revenue.

The company is aggressively expanding into credit, mutual funds, and other services to boost stable interest income, aiming for a more resilient portfolio amid regulatory scrutiny on trading, especially the F&O component, which constituted a bulk of its broking revenue.

Interest income from margin trading facilities (MTF), personal loans, and fixed deposits, jumped 38.7% on-year to INR 149.7 Cr in Q1 of FY26 from INR 107.9 Cr, respectively.

Mutual fund commissions, through Groww’s AMFI-registered distribution channel, contributed 20% to the revenue, up from 15% in FY24, as AUM swelled to INR 50,000 Cr with more than 10 Mn SIPs active on the platform, as per the DRHP.

Other services like insurance tie-ups and wealth advisory are nascent, but promising, with the DRHP stating that the company plans to integrate AI-driven tools for personalised lending and fund recommendations.

Agrawal noted that the market will watch out for the management strategy to diversify the revenue stream and the potential growth drivers in the backdrop of reduced contribution from the F&O segment. The listing of Groww will help investors track performance of the broking industry more closely and in better decision making, he said.

Yet, brokerage fees comprised the primary revenue source. “We derived 84.50% and 79.49% of our revenue from the broking services in FY25 and in the three months ended June 30, 2025. Any downturn in customers’ willingness to use our broking services may adversely affect our business, financial condition and cash flow,” said the DRHP.

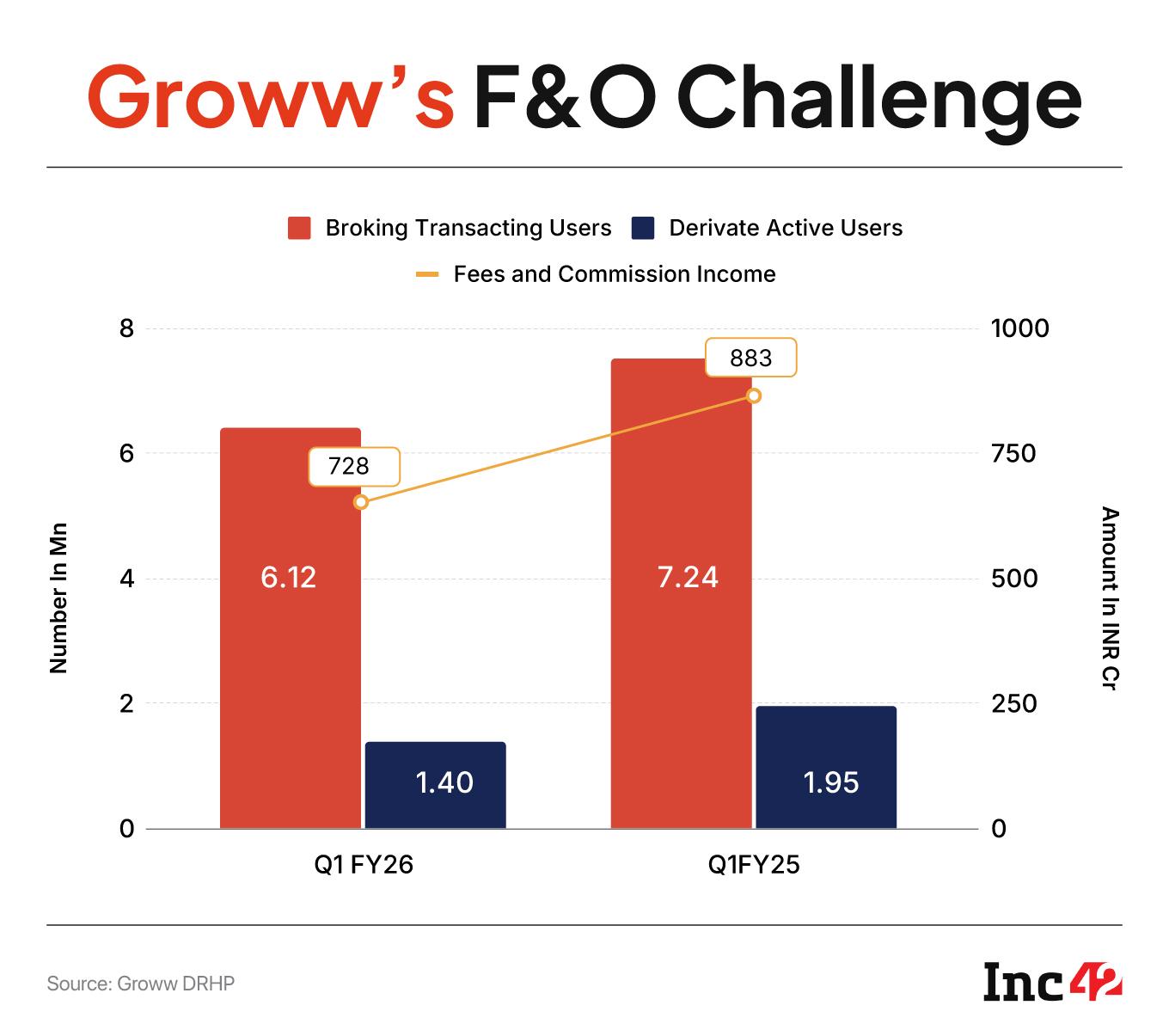

F&O Challenge: SEBI Cracks The WhipGroww’s brokerage-heavy model faces headwinds from SEBI’s crackdown on F&O trading businesses which cast an industry-wide impact of month-on-month decline in the active user bases of major broking platforms, including Groww.

The DRHP shows a 17.4% on-year decline in fees and commission income for Q1 of FY26 to INR 7,28 Cr from INR 883 Cr, primarily because of these changes affecting derivatives trading.

A revenue drop of INR 154.5 Cr in Q1 of FY26 took place on the back of reduced transaction-based revenue from high-volume F&O trades, Groww’s core driver. “Our revenue from broking services declined in the three months ended June 30, 2025 from the year-ago period, primarily due to regulatory changes related to the October 1, 2024 SEBI circular, Charges Levied by Market Infrastructure Institutions – True to Label, and the new framework for derivatives (SEBI circular, Measures to Strengthen Equity Index Derivatives Framework for Increased Investor Protection and Market Stability’ of October 1, 2024),” Groww stated in its DRHP.

“It also declined due to a slowdown in the market in FY2025, caused by various macro and geopolitical factors such as the US-China trade war, monetary policy changes by the US, and global oil price volatility due to conflicts in the Middle East,” it said.

Karamchandani said that all the F&O-focussed discount brokers are facing headwinds from the regulator’s initiative to tame speculative activities.

Market volatility in the last one year has led to muted returns during the last 6-12 months, noted Agrawal. This would have led to the exodus of traders from the market and impacted Groww.

Money Trail: Groww’s Pre-IPO MovesGroww’s journey to the IPO included a strategic pre-IPO round in June 2025, raising $200 Mn at a $7 Bn valuation from GIC and ICONIQ Capital. It bolstered the war chest and validated its profitability pivot ahead of the public float.

This round, part of a Series F extension, saw participation from existing backers like Peak XV, setting the stage for listing.

The company, according to its DRHP, aims to fuel 20-25% annual revenue growth from the funds raised, aiming at more than 20 Mn MAUs by FY27 and deeper penetration in Tier-II and III cities.

Market analysts we spoke to said that Groww made the right move by refiling its DRHP after markets corrected, even though its valuation stays under the cloud.

“Even at a flat valuation, Groww’s PE multiple is 30-35x, which is much higher than other listed broking companies, and it needs to de-risk its bets,” said Sunny Chowdhury of SBI Securities. He warned that persistent regulatory pressure could shave 10-15% off its annual brokerage revenue unless diversified streams scaled up.

As Groww gears up for its market debut, it will need to seek retail trust in a VC-dominated exit listing. Will investors overlook the cashout for the growth promise, or will regulatory shadows and high valuations deter them? The market’s verdict for Groww is expected to redefine fintech IPOs in India.

[Edited By Kumar Chatterjee]

The post Will Groww IPO’s High OFS Portion Be A Concern For Retail Investors? appeared first on Inc42 Media.

You may also like

Coronation Street's Lisa confirms future with Carla after Roy's upsetting discovery

Liverpool can gift Morgan Rogers dream shirt number despite £110m transfer U-turn

Martin Lewis shares how to get free £200 cash before Christmas

Putin unleashes HIV-infected soldiers in desperate bid to capture key Ukraine city

Indian Embassy Issues Travel Advisory as Nepal's Situation Stabilizes