Long before Travis Kalanick, cofounder and former chief executive of Uber, acquired a controlling stake in CloudKitchens in 2018, a Bengaluru-based startup was making waves, whipping up global cuisines, offering a new selection of dishes every day, booking orders via its website and app, providing sturdy packaging suitable for transit and delivering the freshly prepared food within 30 minutes. FreshMenu, founded by Rashmi Daga, positioned itself as a multi-cuisine cloud kitchen with an integrated ordering and delivery model, blending elements of restaurant operations and food delivery platforms.

Now, purists would complain that our analogy does not hold. After all, Kalanick’s venture is the ‘WeWork’ of ghost kitchens (another name for cloud kitchens), providing real estate and technology to companies keen to expand their food businesses, deliver without logistics hassles and minimise overheads for healthier margins. But we aim to emphasise the underlying value of the cloud kitchen concept, delivery-only commissary kitchens without the bells and whistles of dine-in facilities.

Closer home, foodtech heavyweights like Zomato, Swiggy and Ola Foods attempted to integrate ‘food production’ with their seamless delivery networks by partnering with cloud kitchen brands. But by the early 2020s, all three were forced to scale back or pivot, underscoring the challenges of sustaining such operations. Globally, Uber Eats also shut down thousands of cloud kitchens to ensure the food quality of partner brands and weed out spammy listings.

Although the in India is projected to soar from $1.13 Bn in 2024 to $2.84 Bn by 2030, it has encountered significant headwinds, given these business outcomes. The model has flourished in metro hubs like Bengaluru, Mumbai and Delhi NCR, which are driven by rising incomes and a growing working population with little time to cook at home.

However, its expansion beyond Tier I cities has been fraught with challenges. More than 33% of these businesses outside the urban centres closed their doors even before the pandemic, squeezed by razor-thin margins and an over-reliance on restaurant aggregator-cum-delivery platforms like Zomato and Swiggy, which often impose steep commissions on each order. Customer loyalty is a persistent issue for many operators, as few directly interact with end customers.

Amid this turmoil, few narratives could capture the highs and lows of the cloud kitchen space as vividly as . After a good start and steady growth, the trailblazer faced a cash crunch due to multiple factors (more on that later) and was out to raise its Series C round towards the end of 2018. A brutal battle for survival followed, marked by drastic cost-cutting and a concerted effort to build a leaner, more efficient business model, laying the groundwork for a gritty return.

It was a far cry from the frothy early years when VC dollars poured into cloud kitchens like Rebel Foods and FreshMenu or platforms like Zomato and Swiggy. Of course, they were making losses. However, cloud kitchens have already identified huge growth opportunities, allowing them to craft their signatory dishes using culinary expertise and aggregate other food brands. The goal was clear: Scale rapidly and dominate the market by pleasing the palate of all users.

Launched in 2014, FreshMenu built its USP around delivering chef-curated, freshly prepared and globally inspired meals adapted for the Indian palate. It initially operated via its dedicated website and app but later shifted to Swiggy and Zomato. Today, 90% of its sales are routed via these platforms.

Despite the financial woes in later years, the cloud kitchen secured $32 Mn from a clutch of investors, including Lightspeed Venture Partners, Zodius Capital, InnoVen Capital and Florintree Advisors, among others. It currently runs more than 72 cloud kitchens across Bengaluru, Mumbai, Delhi NCR and Kolkata, claiming a customer base of 10 Mn+ and more than 500,000 monthly active users. With more than 300 SKUs in its kitty, the brand serves packed meals and snack boxes to corporate employees and aims to turn its direct-to-consumer website into a B2B2C sales hub.

Although the brand did not disclose its unaudited financials for FY25, the founder projected an annualised revenue run rate (ARR) of INR 150 Cr. With sights set on INR 200 Cr in revenue for FY26 and a target of 100+ cloud kitchens, FreshMenu is now gearing up for its next growth phase. It also targets malls, airports and other retail outlets to expand its business.

FreshMenu’s genesis can be traced to Daga’s earlier startup, Afday, an ecommerce platform for handcrafted products set up in 2011. Despite strong engagement, her first venture struggled to convert browsers into buyers at scale, and Daga had to shut it down after two years. “Despite positive engagement, sales remained sluggish. It was clear that this category needed more time to mature online. So we took a tough call and moved on,” she said.

Another challenge plagued her at the time — balancing new motherhood with a hectic work schedule. She struggled to find reliable restaurants which could home-deliver fresh, good-quality meals in the Bengaluru suburbs.

Spotting a gap in the market, the IIM-Ahmedabad alumnus, who had honed her expertise in sales with startups such as Ola and Bluestone, decided to explore the food industry. Her research revealed a compelling insight. While quality restaurants were located in selected city pockets, food delivery options remained sparse. But what truly caught her attention was the surge of global foodtech startups and the growing presence of players like Zomato, which were experimenting with on-demand delivery, healthy meals and innovative menus.

After months of research into global food trends, market gaps and local palates, Daga started cooking from her home kitchen and leaned heavily on customer feedback to build her brand. The concept quickly found traction among young and busy professionals who loved a variety of cuisines from different parts of the world.

With smartphones and app-based ordering gaining momentum, the founder was confident she could deliver global food at affordable prices using technology. “We wanted to move away from traditional QSRs [quick service restaurants] and make global cuisines accessible to Indian consumers in a convenient, cost-effective way,” she added. She also decided to go ‘full stack’, handling logistics and delivery besides procurement, food preparation and setting up the menu.

FreshMenu was officially launched in September 2014, with its first cloud kitchen set up in under 30 days. Its hub-and-spoke model featured a central kitchen, supported by smaller satellite kitchens across the city, which were close to its customers. It also offered global food — from Asian delicacies to Korean bowls and Mexican burritos to continental delights — tailored for local palates and portion preferences to make every meal exciting.

The brand differentiated itself through frequent menu changes, new offerings, and experiments with meal formats, packaging and affordable pricing (on average, meals were priced at INR 150). It started with mini meals, moved to plated formats — a restaurant-style dining experience typically including a main course accompanied by ‘sides’ — and eventually found massive success with its now-signature bowl-based meals. Frequent variations in the menu also proved effective for marketing, keeping consumers engaged and frequently checking the website/app to see what was new.

FreshMenu expanded quickly, rolling out cuisine-driven sub-brands like Salsito, Donburi and Taaka Chinese, alongside meal-centric options like Bowl Soul and Green Cravings. Many of them were discontinued due to low traction. However, the company’s willingness to adapt to consumer preferences kept it nimble and focussed on the better-performing ones. Currently, all sub-brands collectively contribute around 10% of the total revenue.

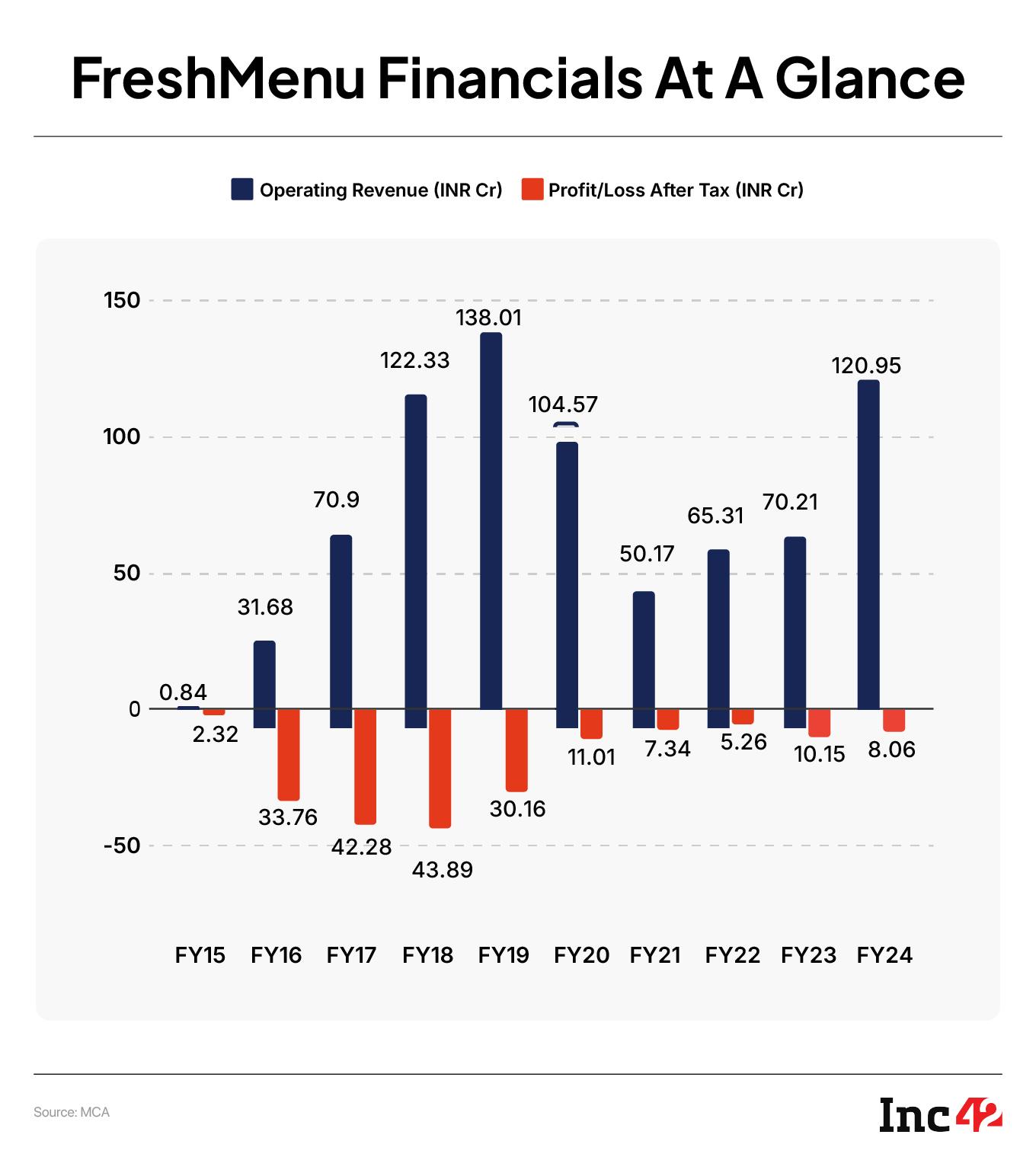

Within four years of its launch, Foodvista India, which owns and operates FreshMenu, breached the INR 100 Cr revenue milestone for the first time, hitting a topline of INR 122.33 Cr in FY18.

Its revenue climbed to INR 138 Cr, and losses shrank by 31.28% to INR 30 Cr in FY19 (from INR 43.9 Cr in the previous fiscal year), its best performance to date.

Apparently, the brand was poised to emerge as a remarkable success story in India’s fast-growing foodtech ecosystem. However, the early momentum also masked its structural weaknesses and blocked its journey to sustainable growth.

What Went Awry With FreshMenu’s Success Recipe: Costs, Competition & CovidDespite initial growth — revenues jumped from INR 84 Lakh in FY15 to INR 31.68 Cr in the next fiscal year, a 3,671.4% rise — its operational costs soared. Its losses ballooned by 1,353%, from INR 2.32 Cr to INR 33.76 Cr over the same period.

Things became tougher with the rise of well-funded food aggregators and delivery platforms like Swiggy and Zomato. Their aggressive discounting strategies quickly eroded FreshMenu’s direct sales and user base.

“Around 2018, 70% of our revenue came from our website and app,” said Daga. “But as Zomato and Swiggy undercut our direct-to-consumer business, we had no choice but to join their platforms, sacrificing a significant portion of our margins to commissions in exchange for visibility. On top of that, we were forced to compete with a flood of new, heavily subsidised brands like EatFit and the Bowl Company.”

The founder cited how cut-throat the discount war could get. When from its German parent Delivery Hero by the end of 2017, it committed a $200 Mn infusion in the food and grocery delivery platform and ran crazy deals to grab market share.

“It offered [dessert] at INR 9 and other food items at abysmally low pricing, eroding market share from players like us who wanted to build a sustainable business. We were selling a food bowl at INR 200 and didn’t have the cash to keep pumping into discounts. Foodpanda, too, was eating into our direct business,” she added.

Interestingly, ride-hailing service Uber (India) entered this market around the same time via Uber Eats but sold its .

FreshMenu’s finances had been badly strained during 2018-2019, driven by sliding margins and high cash burn rates necessary to maintain its premium offerings. But cash burn issues continued to plague the business even at its peak. Its challenges compounded when the brand insisted on controlling every aspect of its fast-paced operations, especially running an in-house delivery fleet. According to the founder, the costs of building technology, running deliveries and huge marketing spend accounted for the early cash burn.

“A multi-cuisine kitchen cooking and delivering global meals was considered risky and impractical. Even experts warned us that continental food would neither thrive in India nor survive the delivery process. But we persisted, focusing on perfecting the menu, packaging and pricing to remain affordable without compromising quality,” she said.

Winning customer love in food delivery takes more than a compelling idea. It demands consistent execution, adaptability and relentless focus on experience. More importantly, there was no playbook for cloud kitchens. FreshMenu had to build the category almost from scratch, which required funds and effort.

“As for challenges, we faced it right after we launched. The only easy bit was setting up our website via Shopify so people could start ordering meals within a week,” the founder said. “I had no food background and was a female founder in a male-dominated space. It meant hiring chefs and a team was incredibly tough. People were sceptical, and many said they would only join if the business took off.”

To build an early team, she had to connect with people on LinkedIn, reach out to chefs and long hours of convincing.

Or take, for example, how packaging evolved at FreshMenu. The brand initially relied on platters split into three to five compartments, and bowls were introduced about 10 months after its launch. But one of the early challenges was securing spill-proof packaging to preserve food integrity during transit. Eventually, the team took matters into their own hands and custom-designed paper packages for sandwiches and burgers.

Meanwhile, FreshMenu grappled with a financial crunch due to fierce competition and an increasing burn rate fuelled by deep discounting. The aggressive funding across the foodtech ecosystem also pressured it to scale rapidly to stay ahead. To cope with the crisis, the brand used nearly all its earnings to cover its expenses as the window to secure new funding closed.

The capital never materialised. Instead of signing term sheets, cautious investors adopted a wait-and-watch approach, wary of how well-funded foodtech startups would deliver following in 2018. Again, existing investors were too keen to minimise their losses instead of bailing out the startup. Although the brand secured a modest bridge round of $500K ($494,575, to be exact) in late 2019, acquisition talks with Bhavish Aggarwal’s Ola Foods and IPO-bound Oyo ultimately fizzled out.

When the pandemic struck in 2020, it badly impacted FreshMenu’s already precarious position. As lockdowns decimated demand, revenue plummeted from INR 138 Cr in FY19 to INR 50 Cr in FY21. It marked a revenue decline of 63.7% in two years. But confronted with an existential crisis, the founder implemented a series of cost-cutting and restructuring measures in an effort to stabilise the business.

How A Lean Model, Focus On Efficiency, Helped FreshMenu’s Turnaround

How A Lean Model, Focus On Efficiency, Helped FreshMenu’s Turnaround In the fiscal year 2021, FreshMenu’s financials painted a bleak picture, marking a nadir for the cloud kitchen startup. But for Rashmi Daga, it was a turning point. “It was a moment of reckoning. After facing some of our toughest days, we began to reassess the business fundamentals and took decisive measures to bring the startup back on track. FreshMenu is quite special. If we can fix the financial side, this can become a major player in the food industry,” the founder said.

Daga embarked on a painful restructuring. She slashed operating costs by shuttering seven to eight unprofitable kitchens, simplified the menu and let go of premium packaging.

The workforce was downsized to 400 to run a leaner corporate team. It also skipped overstaffing during peak hours, prioritising operational efficiencies.

Abandoning the daily-changing menu was a bold move for a brand known for its food varieties. But this step simplified operations and reduced costs significantly. “We learnt frugality the hard way, and we are going to keep it up,” the founder said.

Additionally, the brand strengthened its presence in key existing markets — Bengaluru, Delhi NCR and Mumbai — instead of aggressive expansion across new cities, “The idea is to ensure 100% coverage in the cities we are already in so that customers can order FreshMenu from anywhere within those metros,” the founder explained.

However, the biggest push came in April 2022 (FY23), when from former Blackstone India MD Cyriac Mathew’s Florintree Advisors as part of its Series C funding. The capital infusion provided the lifeline and the critical runway needed to reset the business.

The brand had since cleared its past debts and expanded its operations, adding new kitchens at a fast clip. In FY24, it doubled its cloud kitchen count to drive a steady surge in revenue.

Daga attributed this rapid growth to a strategic overhaul: Simplifying the menu, refining execution and streamlining the supply chain — all aimed at scaling operations swiftly and maintaining consistency across a growing customer base. In FY25, it focussed more on enhancing its offerings and strengthening its supply chain. With kitchen expansion still on the rise, talent acquisition and training also emerged as core priorities.

“Efficiencies in ingredient planning, sourcing from high-quality suppliers and minimising waste through meticulous daily planning have helped us streamline backend costs,” explained Daga.

The brand’s proprietary tech stack, which was developed in-house over the last decade and purpose-built for cloud kitchen operations, was instrumental in its recovery. The system offers real-time monitoring of kitchen performance, order tracking, supply chain management, daily profit-and-loss assessments at the unit level and HR management. “I can view all kitchen metrics in real time on the dashboard, pinpoint issues quickly and resolve them efficiently,” the founder explained.

The turnaround yielded measurable results, with revenue rebounding to INR 65.31 Cr in FY22, narrowing losses to INR 5.26 Cr. By FY24, FreshMenu reported INR 120.95 Cr in revenue, a 72.2% YoY increase from INR 70.21 Cr in the previous fiscal year. Although losses persisted, these were limited to INR 8.06 Cr.

The company is still in the red, but Daga’s broader ambition is to transform FreshMenu into a food company that endures for decades, potentially moving beyond the cloud format into physical touchpoints like mall kiosks and airport outlets. “We understand consumers and their food choices well. The next decade will be about showing up wherever there is an opportunity, maybe even retail,” she said.

Reflecting on a decade of business lessons, Daga told Inc42 that “tough times teach you more than the good ones”. Her most significant personal learning from the tumultuous journey is to build resilience and focus on solving what’s within one’s control.

Following a challenging period, FreshMenu has stabilised its operations, but uncertainties remain in a highly competitive market. While Covid accelerated the shift towards online food ordering, the market has matured into a complex, high-stakes battleground in post-pandemic times.

While FreshMenu was among the early players shaping the category, the market has since evolved, with large, well-funded players like Rebel Foods, EatClub, and others now dominating the landscape, each managing multiple food brands under a single operational umbrella. In short, few companies go it alone anymore, as solving meals single-handedly has become a near-impossible challenge over the long term.

FreshMenu may assert its leadership in niche offerings like food bowls across its markets, but cloud kitchens have evolved into dynamic, tech-powered virtual food halls driven by culinary diversity. These kitchens present a far more intricate and competitive landscape than when FreshMenu first fired up its stoves. The brand’s next challenge will be sustaining its resurgence in a market increasingly defined by consolidation, well-funded competitors and shifting consumer tastes.

[Edited By Sanghamitra Mandal]

The post appeared first on .

You may also like

Nigel Farage vows huge showdown with Labour over Channel migrant housing and hotels

Maharashtra Women's Commission, Hindu Groups Demand Ban On Ullu Show 'House Arrest' Over Obscene Content

Hilaria Baldwin sat on her bathroom floor crying and 'wanted to be dead' after accent criticism

Boost to connectivity, economy, tourism and employment in Northeast India

Lloyd Tennant Appointed Ireland Women's Team's Head Coach