Slim smartphones are struggling to find favour with consumers in India and other countries, forcing their manufacturers such as Apple and Samsung to go slow on production, even offering discounts and halting fresh product launches in certain cases. Retailers and analysts attribute this to the lower value for money for thin smartphone models like Apple’s iPhone Air and Samsung’s Galaxy S25 Edge compared to competing flagship handsets from the same brands. Lightweight smartphones tend to offer smaller battery capacity and fewer advanced features over the bulkier models.

Retailers ET spoke to said initially, the iPhone Air— Apple's thinnest smartphone ever—contributed about 8-10% of the latest iPhone 17 series sales. The share however subsequently slipped to 2-3% during the peak festive period at a time when smartphone demand surged buoyed by cuts in goods and services tax (GST) rates.

For Samsung, slim phone demand has stayed flat despite the brand offering heavy discounts just months after launch.

A Delhi-based retailer said, requesting anonymity, that he has already returned stocks of the Galaxy S25 Edge to distributors, while the distributor for Apple has been pushing units of the iPhone Air along with the base and Pro models of the iPhone 17 series to improve sales in India.

Executives aware of the developments however say sales of the iPhone Air are relatively better in India than in other markets.

Apple and Samsung did not respond to emails seeking comment.

Apple and Samsung did not respond to emails seeking comment.

Demand has been tepid due to a significant difference in features, particularly around battery life and camera in these razor-thin offerings, compared to Apple's bulkier Pro models and Samsung's Ultra models, analysts said, which has led to consumers prioritising purchase of these models over the lightweight offerings, even if they have to pay a little extra.

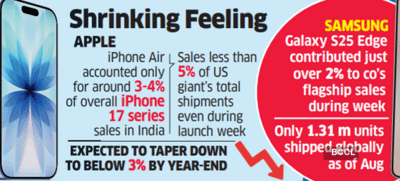

The iPhone Air contributed to only 3-4% of overall iPhone 17 series sales in India, which hit markets in mid-September.

The base iPhone 17 model fetched more attention, per early estimates from market researcher Omdia.

Research firm IDC estimated iPhone Air sales at less than 5% of overall Apple shipments during the launch week, which it expects to further decline to less than 3% by December-end.

Research firm IDC estimated iPhone Air sales at less than 5% of overall Apple shipments during the launch week, which it expects to further decline to less than 3% by December-end.

Similarly, the Galaxy S25 Edge, which hit markets this April, contributed just over 2% during the launch week to Samsung's flagship sales. By the second half of 2025, the share more than halved to less than 1%, per Counterpoint Research.

Stung by the weaker-than-expected response, Apple is expected to slash capacities of the iPhone Air by more than 80% by Q1 2026, said Ming Chi Kuo, analyst at TF Securities.

"iPhone Air demand has fallen short of expectations, leading the supply chain to begin scaling back both shipments and production capacity,” said Kuo. “Most suppliers are expected to reduce capacity by more than 80% by 1Q26.”

Kuo added that some components with longer lead times are expected to be discontinued by the year-end.

Multiple media reports have claimed Samsung has already cancelled a planned launch of a successor next year, due to the low sales volume globally. According to Hana Financial, a Korean financial conglomerate, the Galaxy S25 Edge saw only 1.31 million units getting shipped globally as of August, widely trailing the Galaxy S25 base model’s over 8 million units and the flagship Galaxy S25 Ultra model’s 12 million units.

Retailers ET spoke to said initially, the iPhone Air— Apple's thinnest smartphone ever—contributed about 8-10% of the latest iPhone 17 series sales. The share however subsequently slipped to 2-3% during the peak festive period at a time when smartphone demand surged buoyed by cuts in goods and services tax (GST) rates.

For Samsung, slim phone demand has stayed flat despite the brand offering heavy discounts just months after launch.

A Delhi-based retailer said, requesting anonymity, that he has already returned stocks of the Galaxy S25 Edge to distributors, while the distributor for Apple has been pushing units of the iPhone Air along with the base and Pro models of the iPhone 17 series to improve sales in India.

Executives aware of the developments however say sales of the iPhone Air are relatively better in India than in other markets.

Demand has been tepid due to a significant difference in features, particularly around battery life and camera in these razor-thin offerings, compared to Apple's bulkier Pro models and Samsung's Ultra models, analysts said, which has led to consumers prioritising purchase of these models over the lightweight offerings, even if they have to pay a little extra.

The iPhone Air contributed to only 3-4% of overall iPhone 17 series sales in India, which hit markets in mid-September.

The base iPhone 17 model fetched more attention, per early estimates from market researcher Omdia.

Research firm IDC estimated iPhone Air sales at less than 5% of overall Apple shipments during the launch week, which it expects to further decline to less than 3% by December-end.

Research firm IDC estimated iPhone Air sales at less than 5% of overall Apple shipments during the launch week, which it expects to further decline to less than 3% by December-end. Similarly, the Galaxy S25 Edge, which hit markets this April, contributed just over 2% during the launch week to Samsung's flagship sales. By the second half of 2025, the share more than halved to less than 1%, per Counterpoint Research.

Stung by the weaker-than-expected response, Apple is expected to slash capacities of the iPhone Air by more than 80% by Q1 2026, said Ming Chi Kuo, analyst at TF Securities.

"iPhone Air demand has fallen short of expectations, leading the supply chain to begin scaling back both shipments and production capacity,” said Kuo. “Most suppliers are expected to reduce capacity by more than 80% by 1Q26.”

Kuo added that some components with longer lead times are expected to be discontinued by the year-end.

Multiple media reports have claimed Samsung has already cancelled a planned launch of a successor next year, due to the low sales volume globally. According to Hana Financial, a Korean financial conglomerate, the Galaxy S25 Edge saw only 1.31 million units getting shipped globally as of August, widely trailing the Galaxy S25 base model’s over 8 million units and the flagship Galaxy S25 Ultra model’s 12 million units.

You may also like

Did Charles Barkley just call LeBron James old? NBA Hall of Famer gives twisted reaction to Lakers legend's injury

CPI(Maoist) Odisha wing swears by Naxal movement, denies Devji's appointment as general secretary

Why you're still seeing hairfall even after using "good" hair products

Rashtriya Ekta Diwas: PM Modi pays tribute at Statue of Unity, takes oath to protect nation's unity

'One more game to go': Harmanpreet Kaur keeps focus on World Cup final, hails Jemimah Rodrigues' calm brilliance